Restoring stability Argentina pdf plus technical annex.

TODAY’S SHARP ARS adjustment from 45.3 per USD on Friday to about 53.0—a depreciation of 14½%—comes as no surprise to anyone who has been studying Argentina’s macro-financial policies in recent years.

The catalyst for the sell-off in Argentine assets, of course, was the outcome of yesterday’s primary election—where the opposition Fernandez-Kirchner ticket defeated the so-called market-friendly incumbent, President Macri, by 15½ percentage points. A return of populism to Buenos Aries can be expected.

However, as so often the case, while politics will be seen as the turning point for Argentina’s program, a further sharp adjustment of ARS was already baked in the cake—only the timing was uncertain. Rather, failed macroeconomic policies are to blame. Why?

To understand Argentina’s inevitable demise, it is necessary to recognize that the monetary-fiscal program currently in place—including as part of the IMF’s largest ever program—is a Ponzi scheme. And as with all Ponzi schemes, it’s demise is inevitable. In short, Argentina’s central bank (BCRA) has very few interest-earning assets, but pays a large interest on its sterilization operations—currently Leliqs, previously Lebacs and various other instruments. Without the real resources needed to fund its operations, BCRA has no choice but to monetize the cost of its operations. But to prevent the impact of this on base money, with associated pressure on the exchange rate, BCRA must issue ever greater sterilization instruments as an offset. However, over a long enough horizon, this policy implies BCRA’s monetary plus sterilization liabilities will grow exponentially relative to reserves assets. Inevitably, this must at some point unravel—all that was needed is a catalyst. Yesterday’s election duly delivered.

Understanding Argentina’s Ponzi program with the IMF, therefore, is a prerequisite for beginning to sketch how things will unfold from here—the true implications for sustainability and necessary and sufficient debt restructuring under any new administration. The mistake investors have been making until now is to believe there is a positive “market friendly” outcome, whereas under any administration the true challenge of restoring fiscal sustainability brought only downside for Argentine assets. Today’s adjustment represents a belated imposition of fundamentals.

The evolution of BCRA balance sheet

To appreciate Argentina’s monetary-fiscal dilemma, we need to dig deep into the BCRA balance sheet—and monetary-fiscal interactions in particular. Every year, around July, BCRA produces an annual financial statementfor the previous calendar year. By piecing the information together from these statements, we can build links between BCRA and the fiscal authorities since 2011.

Table 1 shows the net interest income received by BCRA between 2011 and 2017, capturing the end of the previous Kirchner administration and the first part of Macri’s term. In 2011 BCRA was running a deficit of 0.4% of GDP in terms if net interest income. Interest received of ARS3.8 billion, mainly on government securities and international reserves, was more than offset by interest paid of ARS12.9 billion, mainly on BCRA securities. This deficit was roughly unchanged (in % of GDP) through 2013, but increased every year since to reach deficit of 1.9% of GDP in 2017. Interest received increased to ARS29 billion in 2017 while interest paid reached ARS233 billion. Interest received increased 8-fold on a lower base, interest paid increased 18-fold.

Not shown in Table 1, the 2018 financial statement reveals the interest paid on BCRA securities increased to reach ARS383 billion in 2018, from ARS210 billion in 2017—despite a sharp fall in outstanding absorption instruments (more on which shortly.)

And so, while not counted in the fiscal position of the Federal government, BCRA has been running a growing deficit in recent years—to reach 2.2% of GDP in 2018. This hidden deficit is the essential challenge for restoring macro-financial sustainability in Argentina, as we discuss. But first, where has it come from?

Since at least 2011, BCRA has been a source of finance for the Federal government in various ways. One of the several ways has been through the transfer of BCRA net income (including valuation adjustment) to the Federal government.

Table 2 shows the stock of BCRA capital, reserves, and retained earnings, as well as the contribution to the change in BCRA capital due to net income. Note, this net income measure includes valuation adjustments. Since BCRA has a positive net open position in foreign currency, owing to holdings of international reserves, whenever ARS depreciates this creates positive valuation gains. And ARS was on a secular depreciation path over the period—something continued today—meaning there were positive valuation gains throughout. However, this did not result in large upward valuation of BCRA capital and reserves. Why not?

The Federal government implemented a profit sharing rule whereby net income from the previous year—including these valuation gains—was transferred to the Federal government as income. This was not quite 100% in the final years shown, but exactly true for the first 5 years. Consider how net income including valuation gains of ARS78 billion in 2014 was transferred in full in 2015 to the Federal government. Thus, even though there as negative net income cash flows throughout the period, the valuation adjustment was to more than enough to offset this. And so, despite negative realized cash income, BCRA was continuing to transfer profits to the Federal government throughout. Over the 7 years covered, BCRA transferred ARS375 billion to the government, averaging 0.9% of GDP per year. Crucially, it was valuation gains that were being transferred, even if these valuation gains were yet to be realized and all the while BCRA capital was shrinking from 1.4% of GDP in 2011 to 0.7% of GDP in 2017.

But this wasn’t the only source of financing between BCRA and Federal government over the period.

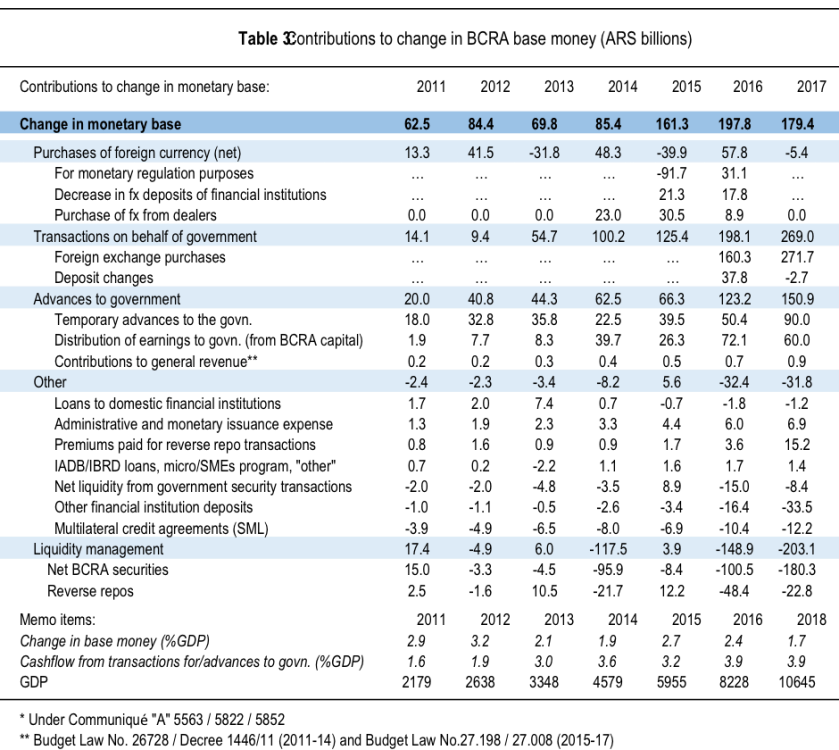

Table 3 provides the best decomposition of contributions to changes in base money in Argentina possible (by me at least) from the varying annual financial statements. The change in base money of ARS840 billion cumulative, averaged about 2.4% of GDP, whereas the change in contributions owing to transactions with the government of various kinds summed to ARS1279 billion, averaging about 3% of GDP. These transactions on behalf of the government include the purchase of FX in later years (when international markets were open for borrowing), the drawdown of deposits, temporary advances to the government, and transfer of BCRA earnings noted above. With respect to the latter, there is a difference between the flows reported in BCRA income statement (Table 2) and the smaller implied cash flow (Table 3) which is assumed without investigation an accrual versus cash distinction.

In any case, the decomposition shown in Table 3 reveals fiscal dominance in Argentina over the period 2011-17. Most important, to contain the creation of base money, BCRA expanded the total stock of outstanding securities—sterilization instruments—by about ARS380 billion (or 3.5% of 2017 GDP.) Crucially, this is a net figure, meaning the interest on outstanding BCRA securities which would otherwise contribute to greater base money creation is being mopped up here; the total increase is considerably larger.

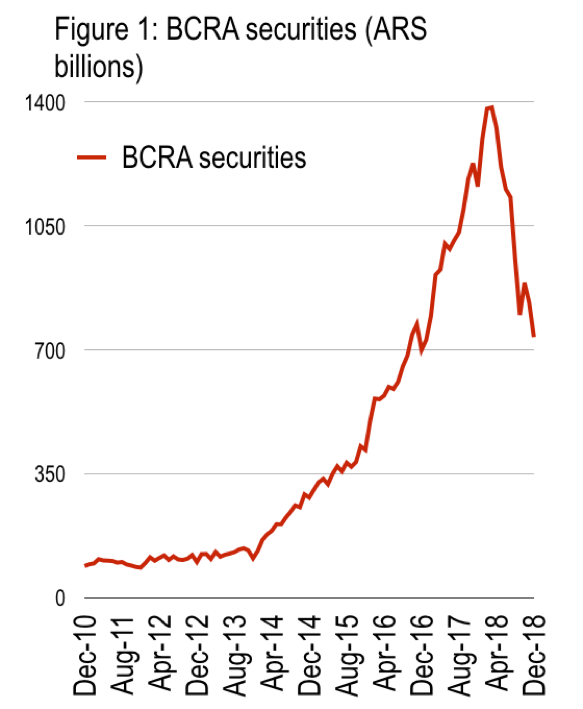

In fact, the total stock of BCRA securities increased from ARS89 billion end-2010 to ARS1,160 billion end-2017 (Figure 1). This exponential increase in BCRA securities, later rolled off somewhat in the crisis of 2018, is a pictorial representation of the challenge of monetary stability with inadequate central bank resources. In effect, to achieve monetary stability BCRA was issuing its own securities in lieu of government debt. This quasi-fiscal debt sits on BCRA balance sheet instead of government. This ought not be overlooked in assessing overall macro-financial sustainability, however.

To assess overall sustainability, of course, requires consolidating the Federal government with BCRA to produce a true assessment of overall State position. But to do so would have stretched to breaking point the intellectual capacity of the Fund—their debt sustainability framework has no meaningful role for consolidated public sector assessment—while working against the political imperative to be seen to support Argentina’s efforts to reintegrate into the international community. And so the IMF’s program was fudged.

The IMF program: death foretold

In brief, the IMF program—amounting so far to a prospective USD56 billion, of which about USD50 billion is a done deal, the largest in Fund history—took note up front of the lack of BCRA capital and the need for action in the future on this, but decided not to deal with this as a prior action. For example, the staff reportat program initiation notes the need to update accounting standards at BCRA while setting as a “structural benchmark” for end-2019 the need to “Recapitalize the central bank to ensure it has the adequate level of capital as percent of the monetary base plus the outstanding stock of LEBACs.”

But such measures, which would have clear fiscal implications, including for sustainability assessments, were illogically postponed. As a result, staff could present a more favourable picture of Federal debt sustainability. However, this overlooked a fundamental inconsistency within the program. While Federal government sustainability requires secular real appreciation, BCRA sustainability in contrast requires secular real exchange rate depreciation to continually revalue foreign assets relative to local currency liabilities.

Absent real depreciation, the BCRA’s monetary policy would be exposed as a Ponzi game in which the value of liabilities would grow exponentially larger than net foreign assets (at any prevailing exchange rate.)

This inherent contradiction sits at the heart of the Argentina program today—as it has from the start. Thus, BCRA securities and overall liabilities (including base money)—despite the apparently tight monetary stance—would far exceed the local currency value of net foreign assets in finite time. The latest IMF 4thReview forecast of this is shown in Figure 2. The only way to correct the imbalance of growing local currency liabilities is through discrete ARS depreciation, to revalue international reserves relative to local currency liabilities. With substantial dollarization of Federal government liabilities, however, this will reveal Federal government debt to be larger relative to GDP than previously thought—as in 2018. Thus, the quasi-fiscal debt of the government imposed on BCRA will show up when BCRA resolves her own unsustainable position.

All this has made ARS adjustment inevitable at some point. For example, the average Leliq interest rate—the interest rate on 7-day absorption instruments—during January through July this year was 61%. The stock of Leliqs was less than ARS500 billion in October 2018, but was on track to exceed ARS1,800 billion by end-2019. BCRA Leliqs were destined in a few weeks from now to exceed base money in size once again. By end-2020, the IMF was forecasting M0 plus Leliqs in Argentina to be nearly double net foreign assets—despite expected exchange rate weakness. Roughly speaking, in the past few weeks, BCRA has been rolling over into 7-day liquidity absorbing instruments about ARS250 billion per day—that’s about 20% of base money each working day. On each occasion, the holders of these claims on BCRA have to ask whether the reward of a 60%-70% annualized interest rate on this one week lending to the central bank is worth the risk that on one of the next 4 days other holders will decide to liquidate the claims and try to purchase USD. If on any day there is a reason to fear rollover in the next week, there is an incentive to run for the exits—precipitating a currency crisis. This is due to the lack of BCRA capital and resources to fund monetary stability, and the ultimate need to monetize the cost of monetary policy.

Ultimately, the need to recap BCRA by end-2019 will have an impact on the fiscal position of the Federal government that has so far been swept under the carpet. The precise size of the recap is impossible to say, but it’s easy to generate (that is, simulate) steady states with an increase of Federal government debt of between 10% and 30% of GDP; with assumed 5% coupon on this debt transferred to the government, this could create an additional interest cost of 2% of GDP per year. This implies the fiscal adjustment in the program would require further painful future efforts to restore monetary sustainability. Alternatively, given the monetary-fiscal adjustment so far has taken a huge toll on the population, fiscal adjustment will likely be paused in favour of substantial debt restructuring. This will be the case regardless of who wins the election in October. It’s time to restore macro-financial stability to Argentina. I believe the existing fiscal DSA ought to add around 20% of GDP in debt in perpetuity to do so, which upends all existing assumptions about fiscal sustainability and the need for restructuring.

END.

Maybe its worth mentioning that IMF analysis of argentinian debt had a chance to be sustainable. The idea of a path of inflation stabilization (obviusly optimistic and far from realistic) including markets confidence (in a Macri reelection scenario) would have let BCRA to reduce interest paid on its securities and achieve a gradual stabilization of Leliqs stock.

Clearly this wasn’t one of the more plausible scenarios but was a consistent one.

Do you agree or do you consider that its also unsustainable? and why?

LikeLike

I actually don’t think it was ever sustainable, though I agree there were circumstances where your argument would hold. I looked at this in detail by deriving the sustainability conditions for BCRA under quite generous assumptions about the cost of issuing BCRA bills. I assume a steady state interest rate of 22% (well below the 70-80% range at that time). Obviously, I also needed to assume lower inflation rates in the steady state, NGDP growth of 18% and 10% secular depreciation. Overall, however, BCRA needed a substantial recap and contribution to income from the government to keep monetary order.

So, I agree with the possibility you mention, but I don’t think it holds weight given the lack of interest earning assets on BCRA balance sheet and the continuous losses faced there.

So I believe there was a substantial restructuring on the cards regardless of the election outcome, however I will never find out.

Click to access argentina_ponzi.pdf

LikeLike

Thanks for your reply. Its really interesting to see in a steady state situation the unrealistic BC income contributions needed from government (implying an unplausible fiscal surplus).

I think this is the one of the flaws of the Macri’s BCRA Monetary initial Plan. They designed an Inflation Target using a Taylor Rule without taking into account all the effects in the BCRA liabilities.

LikeLike